It's the business.. Part II

Saturday, April 8, 2006

It's the business that counts.. says Teh Hooi Ling and according to her, ultimately it is the business that drives the share price.

Ok, Teh Hooi Ling demonstrated why investing because of the cash per share is not a 100% fool-proof method of investing. What about dividends? If a company pays good dividends, will it be a good reason to buy and hold long term to the stock?

Take these comments from William O'Neil, author of ' How To Make Money In Stocks '

- One of my goals is to get you to question and change many of the faulty investment ideas, beliefs, and methods you have heard about or used in the past.

One of these is the very notion of what it means to invest. It's unbelievable how much erroneous information is out there about the stock market, how it works, and how to succeed at it. Learn to objectively analyze all the relevant facts about a stock and how the market is behaving. Stop listening to and being influenced by friends, associates and the continuos array of experts' personal opinions on daily TV shows.

It's also risky and possibly foolish to say to yourself, "I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends." Good stocks bought at the wrong price can go down as much as poor stocks, and it's possible they might not be such good stocks in the first place. It may just be your personal opinion that they're good.

Furthermore, if a stock is down 35% in value, isn't it rather absurd to say you're all right because you are getting a 4% dividend yield? A 35% loss plus a 45 income gains equals a whopping 31% net loss.

To be a successful investor, you must face facts and stop rationalizing and hoping. No one emotionally wants to take losses, but to increase your chances of success in the stock market, you have to do many things you don't want to do. Develop precise rules and hard-nosed selling disciplines, and you'll gain a major advantage.

in which... one can easily say that justification to invest in the stock is there...

1. company's net profits are growing yearly...

2. margins are decent

3. there is a 10% tax exempt dividend yearly.

4. net cash also.

now the company mentioned is MULTI-Code.

It announced its 2001 Q4 quarterly earnings on 20th Sept 2001. The traded prices at that time was 1.52. At that time Multi-co had around 39 million shares. So for fy 2001, Multi-code had an eps of 26 sen.

Based on a price of say 1.52, this meant that Mutli-code had an PER of 5.8x and with a dividend of 10 sen tax exempt, Multicode had a dividend yield of 6.6%.

This makes an investment case, right? The reason to invest in Multi-code was there.... rite?

Justifiable? Let's ass-u-me that one does make such an investment.

so what happen to such an investment?

If one got in Sept 2001.... one would have done really wll.... consiering that Multi-code did manage to edge past 3, for close to a 100% gain, within the next six months...

Brilliant!!! Fantastic!!

but.... imagine if one had used ze "I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends."

look at how this investment would have fared.... !!!!!

See how the stock dived after hitting the rm3.00 peak in 2002?

So what happened?

What about looking at the it's the business that counts.. issue?

From a business perspective, could one have knew when was the time to exit?

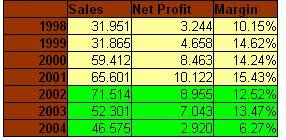

Take a look at the quarterly earnings table below.. read from left to right.. look at the 02 Q4 numbers .. the one highlighted in lime-green. Could one see the drastic change in its quarterly earnings shown in 02 q4 earnings?

Was this the right time to get out? Just from the quarterly earnings, we could sense that there was something drastic happened with Multi-code's business. Its quarterly net profit margins slumped from the 14-16% to a mere 2.85%!

look at the yearly earnings achieved by Multicode after fy 2002.

Wasn't it the right decision to make? To EXIT AFTER fy 2002?

Here's something more intersting..

Multicode announced their Q4 2002 earnings on 24th Sep 2002.

If an investor takes this key to exit, the investor could have had exited at between 1.90-2.00++. (Please verify from these data)

So the investment return was not too bad... entry at 1.52, one could have exited a year later at least 1.90, plus a dividend of 10 sen.... not too shabby at all... :D (and there was a 1 for 10 bonus issue in early 2002)

but.... butt.... buttttt....

if one held on... and applied what William ONeil is suggesting... ie I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends ...... let's examine how one is doing.

let's consider one making an investment of 10,000 shares at 1.52 on Sept 2001, after the Bonus Issue , one would have 11,000 shares. Cost of investment at around 15,200. Multicode last traded at 1.10

let's count the dividends received...

2001 10 sen (10 x 100 = 1000)

2002 10 sen (11 x 10 = 1100) (num shares increased due to bonus issue)

2003 10 sen (11 x 10 = 1100)

2004 7 sen ( 11 x 70 = 770)

2005 8 sen (11 x 80 = 880)

So total dividends received after holding a stock for 5 years = 4850. And based on an investment outlay of 15200, this means that the investor has recieved back a whopping 31% of their invested money.

Fantastic!!!

But... the current share price is 1.10. And since one now have 11,000 shares, the current market value of the shares based at a price of 1.10 is 12,100.

And if you add up the dividend received.. 12,100 + 4850 = 16,950.

Which means, the investor is up some 1750 from their original outlay of 15200. A return of 11.5%.

(ps... this works out to an annual compounded return of only 2.14%!!)

So holding a stock for 5 years.... do you reckon that this is good or is it bad?

How?

Does this sound like a super duper investment idea now?

Or do you agree that it's the business that counts.. ?

And to make it more complicating.. Multi-code reported its 2005 Q4 earnings last Sept.

Net earnings was 4.137 million versus fy 2004 earnings of just 2.889 million. Just imagine what if Multicode did not show such a business recovery.. I am saying this because Multicode last year's low was a mere 1.01. And if I had used 1.01 as the gauge, the five year result would have been more gloom.

It's the business that counts .. right?

Hmmm... anyway let's look back at what O'Neil wrote:

- It's also risky and possibly foolish to say to yourself, "I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends." Good stocks bought at the wrong price can go down as much as poor stocks, and it's possible they might not be such good stocks in the first place. It may just be your personal opinion that they're good.

I think O'Neil teaches us something good here. Do not hold onto a stock just because of its dividends. If the stock earnings performs poorly, the stock will STILL get hit. Which means our investment in the stock will most likely perform rather poorly over the years as shown in this Multicode example.

Now of course, do not misunderstand what I am saying here...

Dividends is indeed great, but for my personal choice, I want that something extra. I would want to see the business of the stocks doing great as well. And the great business will most likely be the catalyst to drive the stock higher.

0 comments:

Post a Comment