It's the business.. Part IV

Monday, April 10, 2006

In the previous post, Its the business.. Part III the example discussed was based on a stock which contniued to pay great dividends despite its slumping business. And if one had purchased the stock in 2002 for the sake of the dividends despite the fact the business was slumping, the end result was pretty poor.

Now let's look at another stock which pays good dividends. Click on the Map of Mumblings and look at the series of blog postings on Yi-Lai , Yi-Lai: ROI Part II , Yi-Lai: ROI Part III , Yi-Lai: ROI Part IV and

Yi-Lai: ROI Part V

Firstly how is Yi-lai's business?

From the first post Yi-Lai ,

Earnings since fy 2001: 21.7 mil -> 26.8 mil -> 25.6 mil -> 29 mil -> 27.8 mil

Ahh... Yi-lai's business wasn't too happening for its latest fiscal year. Latest fiscal year showed that earnings dropped from 29 mil to 27.8 mil.

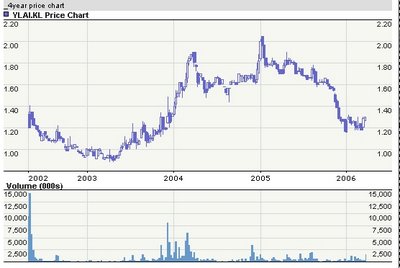

Not too happening right? And doesn't it reflect in the charts?

If one had purchased this stock last year at around 1.80, one would have been left holding some paper losses..

however...

there would be some who would argue that the correction in the stock price is not justifiable given the fact that Yi-Lai's business earnings performance wasn't really all that bad... since one is talking about a 4% slump in yearly earnings...

anyway... let's look at the end-result if one had purchased Yilai way back in 2003 at a price of around 1.05.

Not too shabby isn't it?

Let's ass-u-me that one had invested in 1000 shares of Yi-Lai at a cost of 1.05. Cost of investment 1050.

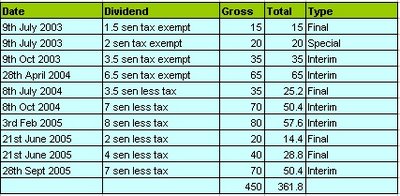

Now let's look at the dividends received by the investor. Here's a snapshot of the dividends paid by Yi-Lai since 2003.

The investor would have received a total gross dividend of 450 or an after tax dividend of 361.80. (but since one can claim these taxes back, I would use 450.00 as reference for the total dividends paid)

So from an investment outlay of 1050, the investor would have gotten a 450.00 in dividends or 43% back of their investment outlay. Which means that the investor current holding cost of Yi-Lai is 600.00.

Currently Yi-Lai last traded at a share price of 1.30. Which means the investor is holding on to an investment gain of 117%!!!

Which works to an annual compounded return of 29.4% for holding this investment for 3 years!!!

Fantastic?

Yup... now compare it with Multicode.

Why the huge disparity?

Ah.. all I can say is compare Multicode's fy 2001 results with current. Back in fy 2001, Multicode earned some 10.122 million and was operating with a net profit margin of 15.43%. Now? Multicode latest net earnings is only some 4.137 million. See the huge slump in business earnings?

Do you believe that ultimately it's the business that counts?

0 comments:

Post a Comment