Regarding Success Transformer

Thursday, May 25, 2006

- Could you share some opinion on Success Transformer

To be honest, when Success Transformer was listed early last year, I was rather biased against this company, for I felt that perhaps the name of this company was perhaps a bit goofy. It was like if the company was a success, why did it need to transform? That was my initial reaction and perhaps I should have taken a little time to research the story behind the company. Star Biz carried a wonderful story on the company background: Tan tansforms from fruit seller to factory owner . And the following article, Transformer maker charges abroad , describes what Success Transformer does.

- Its products include transformers, automatic voltage stabilisers, power line conditioners, high-intensity discharged ballasts and industrial lighting products like floodlights, high-bay and street lightings.

Success Transformer exports to 18 countries including Singapore, Cambodia, Brunei, Bangladesh, Thailand, Japan, the United Arab Emirates, Australia, New Zealand, Indonesia and Thailand.

An electrical products industry player. This is an industry which I am not too familiar with.

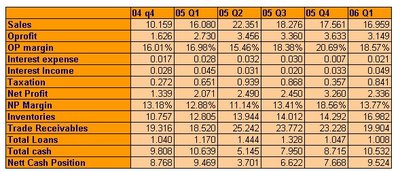

Since it was listed only in Jan 2005, there is simply enough data to pass judgement on this stock and the best I can offer is a compilation of what the company has done since listing.

The initial numbers do look decent and what impresses me is how the company has maintained its cash balances. I would assume that this is due to the owner's humble beginning.

Current earning is around 10.536 million and its current share base is 80 million shares.

Oh, I note also that OSK coverage on it. And the following is a snippet of what it wrote.

- No too bad. STC reported a 5.5% y-o-y increase in sales, from RM16.1m in 1Q05 to RM17.0m as a result of higher volume in the domestic market during the period (refer Figure 5 for comparison between 1Q05 and 1Q06). PBT on the other hand, grew by a surprising 15.7% y-o-y with EBIT margins improved by 1.6 percentage point y-o-y to 18.6%.

- ... Just a tad lower. Annualizing 1Q, top line of RM67.84m was 17.0% lower than our estimates. Our FY06 sales estimates are based on management guidance of a 10% organic growth rate. Although revenue did decline 3.4% q-o-q, we foresee this to pick up by mid-2006. We observed there to be a mild cyclical trend that dips towards the end of the year, and peaks in the middle of the year (refer Figure 4). The lower sales trend in 4Q is a result of shorter operation periods throughout festive seasons. Therefore, we anticipate a better performing 2Q, bringing STC's performance closer to our estimates.

- Growth plans going forward. STC intends to expand its business geographically (target markets include Bahrain, Qatar, UK and Uzbekistan), widen its product range and venture into upstream supporting activities in the coming years to boost profitability. Also, STC's RM3.3m investment in solar related products and equipment upgrades last year is expected to boost its industrial lighting segment, which takes up about a third of its sales (refer Figure 2) by an additional 5%.

- Mini treats to mark 1 st year listing. STC distributed 15.5% of its net profits as dividends in FY05, equivalent to a 2.3% yield based on its current share price. For our projection, we have tagged a payout ratio of 30% translating to a potential yield of 4.2-4.6%.

- Good Catch. Based on a guided revenue growth and sustainable margins, STC is trading at an attractive FY06 PE of 6.2x . We believe the stock is attractively priced compared to the industry average of 8.25x. We also like STC for its edge over industry competitors due to economies of scale in production, as well as its extensive product distribution. Pegging our valuations to the industry average, we arrive at a target price of RM1.17 , equivalent to a 33% upside .

Hope all this helps. Just for your information, OSK fy 2006 net earnings for Success is based on a projected earnings of 11.3 million.

Cheers

0 comments:

Post a Comment