Tanjong announced its earnings yesterday.

What about its German Resort thingy?

Well.. it's net losses increased! (why can't they acknowledge that this simply is a bad project?)

And here's some comments from RHB.

- o RM17.7m operating loss from Tropical Island vs. RM11.4m loss in the 1QFY07 due to a 45% qoq drop in visitor arrivals although this was partly mitigated by a 13% increase in revenue per arrival to €26.

Operating loss increased. A 45% qoq drop in visitors arrivals is most disturbing, isn't it?

LOL!!! Anyway RHB Research is saying that do not be alarmed because all this bad news is already reflected in the share price? (doh!)

- Although the 2Q results represent a "perfect storm" for Tanjong with disappointing earnings from almost all business units, we believe the 6% drop in the share price since June, and 14% for the year to date, has more than compensated for the poor 2Q performance. We expect good news ahead, including progress on the revamp for Tropical Island, as well as more stable power and gaming earnings.

And here's the flashback to what was blogged earlier:

====>>>

Saw this newsclip:

Tanjong's German resort gets another fund injection By Tamimi Omar, 12 Jul 2006 6:18 PMTanjong plc is taking steps to turn around its loss-making Tropical Islands resort in Germany with the injection of another 34 million euros (RM154 million) for its second phase of development over the next two years, bringing the total investment in the project to 110 million euros.

MORE>>

Incredible isn't it?

Let me repost an old posting on Tanjong's Tropical Island Resort Investment (best comment of course was “Compared with net asset or capitalisation, it's not significant at all,” he said.

=======>>>>>>

I was looking at Tanjong latest quarterly earnings when this statement in their earnings notes caught my attention.

- The Leisure segment recorded a RM76 million increase in revenue following the

commencement of Tropical Islands operations in December 2004. The segment registered an operating loss of RM69 million in the current year due to delays in the completion of certain facilities in Tropical Islands which resulted in lower than expected admissions and revenue.

Hmm... commenced in Decemeber 2004, and had operating loss of rm69 million. No wonder Tanjung earnings wasn't too happening this quarter.

Let's go back a year ago, March 2005 and look at how this Tropical Island did. Now the notes in the earnings report was pretty sketchy, so I will use a snippet from RHB research notes back in March 2005.

- Tropical Island Resorts (TIR) losses to continue in FY01/06 but should be immaterial by FY01/07 and turn around in FY01/08. To recap, TIR reported a higher-than-expected operating loss of RM51 versus earlier expectations of RM30m start-up losses. The higher losses of TIR were due to delay in installing a “translucent” roof. The cold weather condition slowed installing work and the doom’s height of 107m did not help. As a result, TIR’s main attraction (the Rainforest) did not have the intended tropical sunlight effects. The delay has resulted in negative publicity, which in turn affected tourist arrivals.

In addition to the start-up losses, the resort has yet to reach its optimum number of visitors and yield. To date, one of the four translucent roofs has been installed. A check with TIR’s web-site shows the significant difference in having a ranslucent and non-translucent roof (refer to the above picture). Installation of the roof is scheduled for completion in 3QFY01/06. We believe pre-completion tourist arrivals are not likely to hit optimal level, especially when it would miss out on the peak holiday season (summer months) in Europe. Thus, we expect TIR to remain in the red in FY01/06. However, we estimate that the operating losses would be trimmed from RM51m in FY01/05 to about RM33m in FY01/06.

We were given to understand that with costs under control, TIR is expected to turn around and commence positive contribution in FY01/07. After the completion of the translucent roof, the company would adopt more focus and aggressive marketing efforts to attract visitors and hope to benefit from the spillover effect of the 2006 World Cup in Berlin. However, we have adopted more conservative assumptions on tourist arrivals and costs. We expect an immaterial operating loss of RM0.2m. For FY01/08, we are forecasting RM11.6m operating profit on account of higher visitors.

So what is this TIR? Well, TIR stands for Tropical Island Resort. A project started by Tanjung back in 2003. And this Tropical Island Resort was built in Brand, 60 kilometer south of Berlin.

Yes, a tropical island resort in Germany. LOL!

- Tanjong and Mr Colin Au propose to enter into a joint venture agreement to develop the land into a "Tropical Island" holiday destination that provides an all year-round indoor tropical environment. The "Tropical Island" holiday destination will house a variety of tropical settings such as rainforest, sea, lagoon, beaches, water parks, exhibition centres, tropical flower world, resort hotels and spas to cater for all age group visitors.

Yup, this is probably what an investor do not want to see. Companies straying way off course in their own business objective. Totally bad.

Even the idea is lousy, isn't it? Say, you are a German and you want to go for a tropical holiday. Wouldn't you want to just fly away to a real tropical island than end up in Brand, Berlin? It wound really sound a drag of a holiday. Those Germans that I know, they really like to travel.

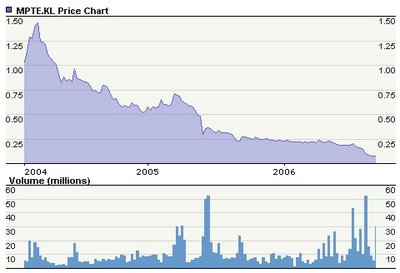

And needless to say, the stock was hammered when Tanjong made the announcement back in June 2003. Here is a short snippet then.

- Business Times - 24 Jun 2003

KUALA LUMPUR

Tanjong shares plunge on German theme park move

Stock falls 6% as investors deem it a poor investment

MALAYSIAN lottery and power firm Tanjong plc's surprise plan to build a mock tropical retreat in Germany knocked 6 per cent off its shares yesterday as investors guessed it may have made a wrong bet.

Tanjong said on Friday it had bid an undisclosed amount for the land and assets of Germany's Cargolifter AG in a joint offer with Colin Au, the ex-chief executive of cruise operator Star Cruises Ltd.

'Trying to have a theme park in Europe is not a good idea. Just look at Euro Disney,' said Nik Azhar Abdullah of Commerce Asset Fund Managers..... 'I'm a bit surprised with the type of investment. The European economy is not exactly booming right now,' said JP Morgan's Melvyn Boey.

And of course, the company was forced to defend itself...

- Friday, June 27, 2003

Tanjong: German park not a significant investment

TANJONG Plc said a bid for 500ha in Germany to build a holiday park will not require a “significant'' investment, addressing concerns its finances will be strained.

“The project is not significant in the context of Tanjong,'' chairman Datuk Khoo Eng Choo told reporters after a shareholders' meeting in Kuala Lumpur.

“Compared with net asset or capitalisation, it's not significant at all,” he said.

How would you feel, as an investor, when you hear the chairman declaring that such an investment to be not significant?

So how much was the total investment? It wasn't until July 7th 2003, that folks like me could read it in the papers.

- Tanjong, Au to spend RM304.6m on German tropical resort project

GAMING and power company Tanjong plc is teaming up with Colin Au to develop a tropical resort in Germany at a total cost of RM304.5 million.

The company said the total cost includes the RM76.1 million or 17.5 million euros cash it is paying for the assets of CargoLifter AG Group.

The assets include a 500ha piece of land situated 60km south of Berlin, Germany. The land currently houses a free-standing hangar measuring 360 metres long, 210 metres wide and 107 metres high.

Tanjong said that two German companies, Tropical Island Management GmbH and Tropical Island Asset Management GmbH will develop and operate an entertainment and leisure based tourist holiday destination with tropical island setting within the hangar. Both companies are 50 per cent owned by Tanjong Entertainment Sdn Bhd, a wholly owned subsidiary of Tanjong.

“The project cost will be funded through a combination of equity funds, shareholder’s advances and bank borrowings to be secured by two German companies,” Tanjong said.

It added that the project is only expected to be completed in the fourth quarter of 2004. “As such, it will not have any material effect on the group’s earnings for the current financial year ending January 31 2004,” it said.

“This project is very much an extension of Tanjong’s existing involvement in the leisure and entertainment business. Over the years, we have been continuously identifying opportunities for the expansion of our business in this sector,” says Tanjong’s chairman Datuk Khoo Eng Choo in a statement to the Kuala Lumpur Stock Exchange.

Au said: “We are confident that this project, when completed, will draw in repeat visitors, especially from Germany and its neighbouring European countries.”

He said the tropical resort is also expected to feature monthly exhibits of a tropical country or region.

“As a start, we hope to work with the Malaysian Tourist Promotion Board to feature Malaysia with its rich heritage of culture, arts, food, architecture, islands, resorts and its rainforest. Also, Malaysia’s cultural groups, musicians and dancers will have the opportunity to perform at the Tropical Island,” he added.

Tanjong also agreed to set up a joint venture company with Au Leisure Investments Pte Ltd to identify, develop and operate entertainment and leisure based holiday destinations with tropical island setting.

The joint venture company, Central Pacific Assets Ltd will have an initial share capital of 5 million euros (1 euro = RM4.35) and an eventual enlarged paid-up share capital of up to 30 million euros. Central will be owned equally by Au Leisure and Tanjong Entertainment.

Tanjong said Au, who has 30 years of experience and expertise in international leisure and tourism industries shall be appointed as chief executive officer of Central. “The position of chairman and chief financial officer of Central shall be nominated by Tanjong Entertainment,” it added.

According to the closed Surf 88 back in 2003...

- The investment cost… With the details now unveiled, the expected investment in the venture is not as massive as earlier feared by investors. The jv will initially be capitalized at Euro 5M (RM21.8M) and eventually up to Euro 30M (RM130.5M). Tanjong’s 50% share hence works out to RM65.3M at the final stage (16.9 sen per Tanjong share or 1.6% of current share price). This is considered a relatively small investment for Tanjong, where funding is not a problem given more than RM300M free cash flow annually (cash flow from operations after dividend and capital expenditure).

So how?

Well, it looks like this 'not significant' investment for Tanjong cost some rm65.3 million.

And the end results?

This fiscal year 2006 earnings for Tanjong showed that the Tropical Island's reported opertaing losses of rm69 million!!

Ahh... when company embarks on a funky corporate exercise, like investing in a tropical island resort, most of the time, the company would end up producing some real funky results too for its investors.

Yeah dude... just play that funky music man!

---

edit 12.09 pm 29th March

found some pictures... via a google search on the phrase 'tropical island resort; brand; germany'..

err... how? look fun ar?

and here is a newsclip on it... Gone troppo in Germany

Read more...

Read more...