Update on TSH Resources

Tuesday, February 28, 2006

I made a blog entry on TSH Resources before in which I highlighted the amazing manner OSK recommended a buy on this stock.

Here is the very bottom-line of what had happened.

I am sure if an OSK subscriber that follows the buy recommendation won't be too happy.

Just in Aug 2005, TSH was @ 1.74 with a buy and a target price of 2.19.

Now in Jan 2006, TSH is @ 1.47 with a buy and a target price of 1.78.

TSH was trading at a price of 1.40 the other day when it made its 2005 Q4 earnings.

And the very same analysis who had made all those calls, dared to remark in the following manner.

- Just a hiccup! Net profit of RM29.7m was 34.1% and 28.7% below consensus and our forecast respectively. This is predominantly due to a write back in tax credit amounting to RM8.9m (being reinvestment allowance realised in FY04) after the company has now been granted a 10 year pioneer status for its biomass subsidiary commencing FY04.

My issue with that analysis is if an OSK subscriber had followed the recommendation, I'm pretty sure that they would not be too happy at all with what had happened to the stock price since the recommendation. And worse of all, the stock performed way below OSK forecast.

Let me repeat what I posted again.

On Aug 25 2005, TSH announced its earnings and OSK mentioned that 'its earning was 36.8% below market and our estimates'. Now the very problem was OSK forecasted a shocking 61 million net earnings for TSH. (Ah.. the higher the profit estimate, the cheaper the stock would appear... hence the juicier the BUY recommendation!). Now since TSH is going to miss the forecast earnings by a lot, OSK quickly readjusted TSH earnings to just 55.7 million.

Price of TSH then was 1.74. OSK target price was 2.19.

On Nov 25 2005, TSH announced its earnings. Total year-to-date 3 quarters net earnings for fiscal year 2005 was only 28.253 million. One more quarter left and OSK had expected TSH to earn some 55.7 million. And obviously this was getting really embarrassing. And what OSK did next was even worse. The earnings forecast were no longer to be found (not sure if it was my browser) and instead OSK still insisted it was a buy. It said 'We reiterate our BUY recommendation with a 12-month target at RM1.78 based on sum of parts methodology."

Sooooo....... price of TSH was now at 1.47. And OSK was calling a buy based on sum-of-parts (meh leh ka?) on TSH with a target price of 1.78!!!

Now if one puts those two past events into perspective... wasn't it disgusting that OSK is now saying it is a mere hiccup? And even more disgusting was how OSK said TSH performed just 28.7% below their estimates!!!! Why couldn't they admit their past overly optimistic earnings forecasts?

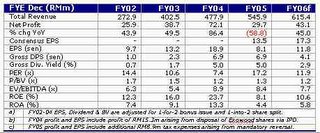

And guess what... OSK forecast for FY 2006 is now only at 43.1 million! LOL!! (see table below)

Now take a look at their earnings table posted in their Aug 2005 report. LOL! They had a forecast net profit of 68.7 million for fy 2006. (see table below)

Waitttt..... guess what.... i found OSK earnings table posted in their July 2005 report. And fy 2006 forecast was at a whopping 73.4 million!! (see table below)

Truly amazing isn't it?

Look at OSK earnings forecast for TSH fy 2006.

From 73.4 million -> 68.7 million -> 43.1 million!!!

Hoi! This bugger playing masak-masak ka?

Oh and guess what?

- Downgrade to NEUTRAL . Given the required gestation period, we are downgrading TSH to Neutral with 12-month target price ofRM1.49, based on sum of part valuation methodologies on estimated FY06 figures. Nevertheless, we would reckon investors to retain TSH under their radar given the strong catalysts moving forward.

Downgrade wor!

- Just in Aug 2005, TSH was @ 1.74 with a buy and a target price of 2.19.

- Now in Jan 2006, TSH is @ 1.47 with a buy and a target price of 1.78.

- Now in Feb 2006, TSH is @1.40, downgrade to neutral with a price target of 1.49!!!!!

And let's not forget that the 12-month target is based yet again on sum of part valuation!!!

Anyway how has TSH been doing?

Ok, firstly last year's earnings were boosted by that one-off gain from the listing of Ekowood, of 15.336 million. Secondly, there is this tax credit adjustment in TSH account for this quarter. So to get a rough understanding, let's take a look at the Profit Before Tax (PBT) numbers for TSH recent years.

PBT Since 2001: 19.458 million, 30.174 million, 49.470 million, 67.709 million, 49.788 million.

(note last year's PBT was actually 83.045 but i minus out the one-time gain of 15.336, which meant the adjusted PBT for TSH for last year was 67.709 million)

As you can see clearly, TSH current earnings simply isn't happening. And let's not forget the fact that last year, TSH warrants were fully converted to ordinary shares, which meant a drastic dilution in earnings per share. Ouch!

ps. TSH closed yesterday, 28th Feb 2006 at a price of 1.31!