Regarding RUB

Monday, May 22, 2006

- Could you share your opinion on RUB and explain why pe ratio so low?

First of Ranhill Utilities was listed in the exchange back in 2002 (ipo price was 2.50). And based on the reported earnings, its current 4 quarters earnings totals some 125.690 million, its current earnings per share is 42.7 sen. And based on a closing price of 1.34, it is trading at a current pe multiple of only 3.13x.

So yes, RUB is trading at a very low PE ratio.

Firstly, to understand why the PE ratio is so low, perhaps we need to understand the PE yardstick. The PE yardstick merely indicates how the stock is trading in the market when compared to its earnings. And of course it gets complicated when one uses the yardstick in an advanced manner by using a projected (forward) earnings. And some even base the earnings on a projected 2 years earnings into the future. Which of course could get pretty complicated and the accuracy of the projection is always very subjective for one is forecasting the future earnings.

Anyway, the most important thing to remember is the yardstick measures how the stock is trading on the market when compared to its earnings.

And the most important thing is that one needs to realise that the yardstick does not indicate the quality of the stock!

Meaning to say, stocks trading at a low PE multiple does not necessary mean that this is a good stock and neither does it necessary mean that it is the hidden gem. As the saying goes, never say I ass-u-me!

Before continuing, one thing I would like to point out is that perhaps you should look at how RUB has performed since listing.

How? Doesn't it appear that the stock is on a clear decline?

So what is wrong with this stock?

The company is reporting more earnings than ever and based on the current earnings of 125.690 million, the company could be on track to record its best ever earnings but yet the stock is decling even more!

Has the market got this stock really wrong or is the market correct and that this stock has some serious issues which is causing investors to avoid it like plague?

Perhaps we could get a better understanding if we take a good look at RUB earnings and its balance sheets.

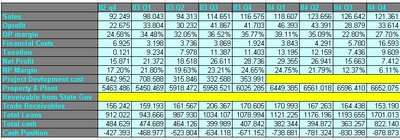

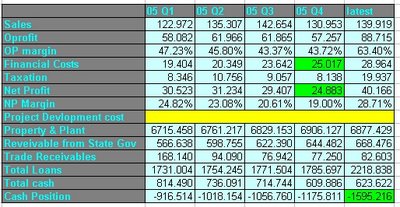

The below two tables represent the compilation of RUB quarterly earnings since its listing.

1. Just for the record, did you know that RUB reported it has earned some 346.692 million since its listing? (this figure is derived if you add the total of net profit in both tables)

So for a company generating so much 'wealth' what does an investor get?

2. The last row indicates the cash position (total cash - total loans) of the company. At the first column, RUB's 02 Q4 earnings, RUB was in a net debt position of 427.393 million. Look at the latest column; it states that RUB is now in a net debt position of 1595.216 million. WOW!

3. Debts. Look at the very last column. Total loans now total some 2218.838 million. WOW!

4. Now let's put this debt into perspective. Look at the 05 Q4 quarterly earnings. See the two green boxes. The financial cost for that quarter totals more than its earnings! And if you add the most recent 4 quarters financial cost, RUB paid 97.972 in financial costs!

5. When RUB first reported its earnings, it has this entry called 'project development cost' under its current asset. This went on from 02 Q4 to 03 Q4. And the next four quarters, this project development cost disappears and my guess it is lumped under 'property and plant'. And what is even more interesting that in 05 Q1, there is now an entry called 'receivable from State Govt'. In 05 Q1, this amount was 566.638 million. The latest? 668.476 million! WOW!

So from RUB listing till now, what wealth has it generated?

Ah, this is a very important issue. Some call it gauging the quality of a company's earnings.

What kind of wealth has RUB generated since it reported earnings totaling some 346.692 million since listing?

Well, its property and plant seems to be worth more. State govt owed them more money.

But most important, the very bottom line is that it is now in a net debt of 1595.216 million!

Do you see any wealth at all?

If the answer is no, then the quality of RUB's earnings and the quality of the management is seriously in question.

And if you put all this into perspective, isn't it clear why RUB is trading at such a low PE multiple?

And if that is the case, does it make sense risking your hard earned money in this stock?

How?

Btw, if not mistaken, I have read it before that RUB will not be paying any dividends till 2012!

Last but not least, these are my opinions of this stock as requested. If you think my reasonings is wrong, then it is wrong ok? Please make sure your own judgement and reasoning is sound in your own investing decisions. My opinions are mere second opinions.

Cheers!

0 comments:

Post a Comment