Of Gamuda and the Construction Sector

Tuesday, October 3, 2006

Saw this article on the Edge in which Citigroup stirs up the construction section by suggesting the possibility of M&A!! ( more )

- Citigroup Investment Research said on Oct 3 opportunities are abound as companies with low valuations may attract interest of potential suitors or partners to rise on the construction upturn. Based on a price-to-earnings ratio/price/book basis, there are several companies which look interesting. They are Road Builder Holdings Bhd, Sunway Holdings Bhd, Ranhill Bhd, WCT Engineering and MTD Capital Bhd. “These companies’ low valuations may attract the interest of potential suitors or partners to ride on the construction upturn,” it said.

- Another angle for M&A could be the acquisition of expertise or attractive assets. It said a focus on the Ninth Malaysia Plan (9MP) on water infrastructure could spur interest in companies with relevant expertise. “Big-cap construction companies under our coverage such as Road Builder, IJM Corporation Bhd and Gamuda Bhd, do not have major shareholders with more than a 50% holding. This could pave the way for possible mergers between these companies with suitable candidates,” it said.

Wah! As the local saying goes 'macam-macam pun boleh!' (Anyhow also can!)

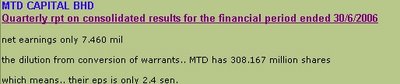

Take MTD Capital.

So how cheap can MTD be? Based on what? Doesn't earnings matter?

Book basis? Here's something to ponder upon. A company can have tons of contracts on their books but what good are these contracts if they cannot turn it into dollar and cents!

How?

Show Me the Moola dude!

More can be read here.

Or about Ranhill? Ranhill just registered a loss of 49.474 million for its most recent quarter.

Or how about Gamuda? Let's look at the market leader.

This one, I had a good discussion here. here

Let me reproduce it again for easy reading:

Hi Dycarr,

I do have a couple of issues I want to share with you on Gamuda.

Ah...Gamuda has just announced its final quarter results for 06 and it was hardly suprising with EPS for full year 22cts.

. A final dividend of 9cts as per last year was declared

. A final dividend of 9cts as per last year was declared

Let's talk about its business.

The big picture of its earnings, isn't really a pretty at all, in my opinion. (ps. let's leave the issue of the quality of the company/management etc and just talk earnings. Since after all, it's all about Gamuda and its earnings, right?)

First thing I would look at it's quarterly earnings..

And as you can see it's rather flat and lacklustre.

Ann Date Reporting Q Revenue Profit/Lost

29-Sep-06 31-Jul-06 4 440,361 41,782

22-Jun-06 31-Jul-06 3 249,838 40,151

23-Mar-06 31-Jul-06 2 243,031 40,027

20-Dec-05 31-Jul-06 1 293,667 46,598

Now Gamuda used to be a GREAT construction stock. The market leader, whose reputation was based on its stellar earnings growth per year, which saw the stock hitting its peak end 2003/early 2004 at around 8.00.

So obviously, based at current price, around 4.00, perhaps that there is some justifications that 'perhaps' the share is cheap enough or as they say, the poor/lacklustre earnings has been reflected in the stock price.

True. That's sometimes a valid justification or reasoning to bet on the stock.

But...

Perhaps it would be interesting to see what was the main driver/catalyst that drove the stock so high, and for me it was the stellar earnings growth achieved by Gamuda. The earnings really was top-class.

FY Sales Revenue

2000 637.488 146.815

2001 830.763 191.708

2002 1042.752 193.899

2003 1442.069 241.773

2004 1719.032 281.869

Based on the table above how could one argue Gamuda was no good?

And wasn't it clear how the impressive growth in earnings was probably the main cause that drove the share so high? Long term investors would have been proud.

But....

Things have changed.

The landscape has changed.

Growth as they say it's rather finite...

Now if I add in the last 2 year earnings (including yesterday earnings report), here is a different picture.

FY Sales Revenue

2000 637.488 146.815

2001 830.763 191.708

2002 1042.752 193.899

2003 1442.069 241.773

2004 1719.032 281.869

2005 1661.453 265.778

2006 1226.987 168.558

Two years of decline. This fiscal year's earning was really poor. And based on the earnings revenue of 168 million, this would put Gamuda back to the levels it achived in its fiscal year 2000.

As they say, the good times is over for now.

So perhaps it would be better to remember that the 8-ringgit-Gamuda and current Gamuda is 2 totally different animal. The 8-ringgit-Gamuda had stellar earnings growth riding on its back. The current 4-ringgit-Gamuda is riding on the back of a serious decline in its earnings. Two different animals.

And as you have said, the poor earnings is expected.

Delay in recognition of revenue of on-going projects, completion of SSP3 and the delay in NT1 Laos (which was supposed to commence 2 years ago) were partly the reasons results are weak.

And as you argued that you expect next year earnings is to pick up strongly. But where will the earnings driver come from?Moving forward, GAMUDA should resume its growth path with larger contribution from projects in middle east and NT1 Laos and its property development division. Naturally, it is also eyeing a slice of some of the targeted larger projects at home and I would be suprise if they are not successful.

Very much possible. I WON'T be a bit surprised at all.

However, I will be extremely cautious. I believe that Gamuda is paying the price of its earlier success and the issue of the size and reputation of Gamuda itself. Remember Gamuda is now really considered a five-star-construction company based on what it achieved from 2000-2004.

But....

The five-star-construction stock is simply missing the GODZILLA-sized mega, mega contracts it was enjoying back in the those days. Remember the issue of companies venturing overseas? The risks are so much more and yet these companies are willing to do so simply because the huge chunk of meat in our kampung is no longer as meaty.

And because of these reasons.. i would be cautious.

==================================

However, most research houses are still upbeat about Gamuda.

Here's JP Morgan comments

- · The poor results for FY06 was mainly attributed to the slowdown in construction sector, which witnessed 33% drop in revenue Y/Y. The property segment remained flat, and management continues to guide for modest growth from their existing developments in Valencia, Kota Kemuning and Bandar Botanic. Growth in property will come from Bandar Nusajaya in South Johor as the pump priming projects are targeted for kick-off in CY07.

· Management indicated that earnings growth for FY07 will be driven by the incremental orderbook from 9MP and remains optimistic of their chances to revive the double-tracking project. SAE and LDP toll concessions will still expect a toll hike soon, though timing of the implementation has yet to be finalized. All other business segments should expect a flat and stable outlook.

· We remain OW and maintain our Aug-07 PT of M$4.80, based on a RNAV approach - valuing their normalized construction orderbook at a P/E multiple of 15x, 9MP anticipated orderbook using a DCF valuation, property earnings at a P/E multiple of 10x, and DCF valuation for the rest of their toll and water concessions. The risks to our call and target price depend on the successful implementation of 9MP and the implementation of the toll hikes.

JP Morgan remains Ove-Weight and maintains a price target of m$4.80.

CIMB has it as a TRADING BUY with a trading target price of rm4.30.

- RM4.02 TRADING BUY Maintained Target: RM4.30

Gamuda

Slow and steady

• Broadly in line. FY7/06 net profit amounted to 96% of our forecast and 97% of consensus. Topline declined by 26% but net profit slumped 37% as weaker construction margins dragged EBIT down 56% and the tax rate rose from 27% to 35% due to non-deductible expenses.

• Dividends maintained. Despite the lower earnings, Gamuda kept its full-year DPS at 16 sen, with a final DPS of 9 sen, in line with our forecast. This translates into a decent yield of 4%.

• Construction contraction. Construction revenue fell by 33% but its pretax profit tumbled 79%, mainly because of a 14.4% pt drop in construction pretax margin to 6.6%. Management attributed it to (i) continued glitches for the SMART project, and (ii) the completion of major contracts in 3Q06.

• But other divisions stepped up to the plate. The water-related and highway concession division chalked up solid pretax growth of 54%, which helped to plug a big part of the hole caused by lower construction margins. The strong growth came from a 27% increase in revenue from its two Indian highway concessions and higher capacity payments for its water concession.

• A 9MP winner? The Ninth Malaysia Plan holds much opportunity for contractors like Gamuda, particularly in the form of PFI jobs. Some of these projects entail significant engineering works, namely flood mitigation system, inter-state water transfer and railways. The revived RM14.5bn double tracking project could provide a fillip to Gamuda’s earnings if it comes through.

• Reiterate TRADING BUY. Our FY7/07-08 earnings are adjusted upwards by 2- 3% to factor in lower tax rates while we introduce an FY7/09 forecast. However, we retain our target price of RM4.30, which is based on a 30% discount to its RNAV. The key share price catalyst would be the award of bigger jobs that enlarge its order book significantly. Since our upgrade to TRADING BUY on expectations of a bigger flow of positive news, the company has secured two projects worth RM866m, taking its order book to RM2.5bn as at July-06

RHB was more optmistic despite its cautious views with a fair value of 4.94. Note that RHB realises that Gamuda can only start booking in profits from its Nam Theun project in fy07/08.

- Earnings To Catapult Later Than Sooner

Share Price : RM4.02 Fair Value : RM4.94 Recom : Outperform (Maintained)

RHB RESEARCH INSTITUTE SDN. BHD.

X FY07/06 net profit came in within our forecast as well as the market expectation.

X We are downgrading FY07/07-08 net profit forecasts by 38% and 17% respectively largely to reflect the management guidance that:

1. Realistically, Gamuda can only start booking in profits from the Nam Theun 1 Hydroelectric Power Project in Laos from FY07/08 as it is unlikely to hit the first 15% billing milestone in FY07/07. We had assumed the project to start contributing in FY07/07; and

2. Gamuda is expecting "finer" margins from its projects in Qatar due to the rising costs of bitumen, diesel and stones. Contributions are also not expected to stream in as quickly due some delays with regards to the site possession (of which Gamuda will not be held liable for LAD).

X However, indicative fair value based on 12x forward EPS is unchanged at RM4.94 as we roll over the base year from FY07/07 to FY07/08. We believe. Gamuda’s earnings recovery is delayed, but not denied. Also, in our earning forecast for Gamuda, we assume Gamuda to secure RM1.5bn worth of new contracts per annum in CY2007-2009.

X Against the 8MP, development expenditure in the 9MP is 17.6% higher at RM200bn, or 29.4% higher at RM220bn if RM20bn under the private finance initiatives (PFI) is included. Similarly, as compared with a year ago, development expenditure under the 2007 Budget is 24.3% higher at RM44.5bn, or 35.5% higher at RM48.5bn if RM4bn under the PFI is included. These augur well for all construction boys including Gamuda.

X Given its strong track records and engineering capabilities in tunneling, water supply and flood mitigation works, we believe Gamuda stands a good chance of winning or at least playing a substantially role in: (1) Tunneling works for the Pahang-Selangor Inter-State Raw Water Transfer project; (2) A new railway tunnel in Padang Rengas, Perak, with an estimated cost of RM800m; (3) Construction and upgrading of water treatment plants and dams; and (4) New flood mitigation projects.

X We like Gamuda for the following reasons:

1. A vibrant local construction sector over the medium term on the back of the 9MP and Gamuda’s fortes in tunneling, water supply and flood mitigation works;

2. Gamuda’s good earnings visibility underpinned by an outstanding construction orderbook of RM4bn (see Table 3) that could keep it busy for the next 2-3 years; and

3. Gamuda has a large market capitalisation and high share liquidity, and it is an established name among the local and foreign investors. Maintain Outperform..

So was OSK who reconds that the prospects are rather exciting for Gamuda and places a value of 4.70 for it.

- Exciting ProspectsAhead

Below expectation. Net profit of RM169m fell short of our forecast by 10% and 8% below consensus, attributed mainly to weak construction earnings and the slowdown in property sales.

Weaker y-o-y performance. The group revenue and operating profit were down by 26% and 53% respectively, on the back of the completion of construction works for the Sungai Selangor Supply Scheme Phase 3 ("SSP3") and the two highway projects in India.

Revenue Op. Profit

Better q-o-q numbers. Revenue and pretax profit were up by 76% and 29% respectively underpinned by higher contributions from property water and expressways.

Improving construction activities. The construction division which has been underperforming over the past few quarters is expected to rebound in FY2007 on the back of an expanding order book from RM2.8bn a year earlier to RM4.1bn. Two big projects in Qatar (Dukhan Highway and Doha Airport works) are currently underway totaling RM1.8bn. In addition, it recently secured the RM640m Bahrain causeway works which should start by year end.

The RM2.5bn Laos Hydropower project is not expected to be affected by the recent coup in Thailand and works should commence in the near term. The green light from EGAT of the Nam Theun 1 Hydroelectric power proposal paved the way for the finalization of the Power Purchase Agreement with EGAT and Concession Agreement with the Laos Government. However, we are wary of the execution risk of this project as evidenced by the troubled start after delays of more than a year.

Flattish income from properties. Property contribution is not expected to rebound due to the limited growth prospects and with the near completion of Kota Kemuning. Its long term growth prospect will be from the commencement of its JV with UEM Land at Bandar Nusajaya at the end of this year should provide an upside potential in earnings for FY08 and onwards. The group also plans to develop a township near Kajang but it is still early to deduce anything from it.

Growth driven by concessions. Going forward, growth would be driven by the concession division in view of the imminent toll rate hike in 2007 for Kesas Highway and LDP, and the launch of Gamuda’s Indian toll concession. We expect traffic to drop early on from the initial reaction post rate hike but should normalize in due time. In addition, the full commissioning of the SSP3 would provide further boost to its bottomline.

9MP prospects. So far, there have been very limited announcements regarding the status of the 9MP projects. As for Gamuda, its prospects for the 9MP most would most likely stem from water projects, namely the Pahang-Selangor Interstate Water Transfer and flood mitigation projects. It still unclear on the potential award of this contract but judging from track record, we feel that Gamuda is in with a shout given its experience in the Selangor water project via Splash and the SMART tunnel flood mitigation project.

Compelling valuation. At current juncture, the counter is trading a 17% dscount to its target price, which we derived from a RNAV calculation of RM4.70/share. Maintain our BUY call.

How?

Are you optimistic about the construction sector?

And oh about the M&A. LOL!! In my opinion, Citigroup is merely cooking up a storm... however, I am realistic enough to understand that anything can happen in the market. Deals can always be struck between anyone. For example the Business Times is also cooking up a storm in RoadBuilder too:

- Huge off-market deal fans Road Builder takeover talk

The market has been buzzing with talk that IJM Corp, Malaysia's second largest construction company by sales, could be the predator

0 comments:

Post a Comment