Crest Builder Again

Tuesday, November 14, 2006

This was what OSK posted today.

------------------

OSK - Tuesday, 14 November 2006

Crest Builder Hldgs

Fulfilling The Prophesies

BUY Price RM1.18 Target rm1.84

Mervin Chow Yan Hoong

As prophesised! CB’s share price has risen by 24.2% since our last BUY call a month ago! In fact, much of the gains were attributable to the following catalysts that we have vehemently been advocating:

(i) 3 Two Square development with a GDV of RM180m is nearing completion, coupled with encouraging take-up of almost 60%, thus the larger bulk of earnings from the project will flow in 2H06 and onwards. This is pretty much within our expectation and hence has been priced into our forecasts.

(ii) As was reported in the press, CB is quite confident in securing a PFI project for the construction of a Government complex that could potentially worth at least RM350m-400m. So far, details from this remains sketchy hence we have not priced this into our forecasts and valuation.

(iii) Sale of condominiums en-bloc in Batu Tiga, Shah Alam (Figure 4) to Syarikat Perumahan Negara (SPN) for about RM140m will give the Group a much stronger foothold in achieving our forecasts going forward. Incorporating this and assuming the development works will begin end of this year, CB would be registering a net profit of RM33m and RM48m in FY06 and FY07 respectively, from RM32.9m and RM45.6m previously. If we were to roll over our figures to FY07 based on this hypothetical analysis, CB would have a 12-month target price of RM1.93 (Figure 1 and 2)!

HOT….! Even with the en-bloc sale aside, CB is to achieve an astounding YoY net profit growth of 169.7% and 34.7% in FY06 and FY07 respectively, an impressive 3-year (FY04-FY07) net profit CAGR of 41% and commendable ROE of 31% and 31.3% in FY06 and FY07 respectively (Figure 5), backed by strong outstanding orderbook of >RM700m and the huge earnings contribution from its property development arm (Figure 3 and 4).

Still cheap, join in the party! In spite of the recent strong run-up in price, CB is still trading at a forward PE of 5.2x and 3.8x for FY06 and FY07 respectively, significantly lower to its peers average of 7.0x!

BUY. Rolling our figures over to FY07, we are upgrading CB’s 12- month target price to RM1.84 (Figure 6 and 7). Coupled with a potential gross dividend of 9.2sen and 12.8sen or a gross yield of 7.8% and 10.8% in FY06 and FY07 respectively, we reiterate BUY.

EARNINGS OUTLOOK

Strong and solid growth. Riding on the back of its current strong outstanding orderbook of over RM700m and the enormous earnings contribution from its property development arm going forward, CB should be able to achieve an astounding YoY net profit growth of 169.7% and 34.7% in FY06 and FY07 respectively, an impressive 3-year (FY04-FY07) net profit CAGR of 41% and commendable ROE of 31% and 31.3% in FY06 and FY07 respectively (Figure 5).

Note that these figures have yet to include the potential sale of the Batu Tiga development worth RM140m and the potential inclusion of a PFI project worth more than RM350m-400m.

VALUATION AND RECOMMENDATION

Reiterating BUY with higher target price. CB’s stock price has gained 24.2% since our last BUY recommendation just a month ago! Based on the Group’s current hare price of RM1.18 and forward fully diluted FY06 of 22.8sen and FY07 EPS of 31.4sen, the Group is currently trading at a forward PER of 5.2x and 3.8x in FY06 and FY07 respectively, a significant discount of 26% and 46.3% to its average peers’ PE of 7.0x. This is unjustifiable given CB’s strong and solid earnings prospects.

Over the past 3 years, Crest Builder has been paying 4sen less tax dividend to its shareholders, translating them to a yield of 3.4%. According to management, the Group will be paying 25% of its earnings to its shareholders as dividend in FY06.

Based on our FY06 earnings forecast of RM32.9m and assuming a 25% payout at current share price should potentially translate a gross dividend of about 9.2sen less tax or a gross yield of 7.8%. Based on our FY07 earnings forecast of RM45.6m, and assuming the same payout ratio at current share price, CB could potentially pay a gross dividend of about 12.8sen less tax in FY07, translating to a gross yield of 10.8%.

Rolling our figures to FY07, we are upgrading CB’s 12-month target price to RM1.84 based CB’s Fully-Diluted RNAV and ascribing its average comparable peers’ PE of 7.0x to its FY07 Fully-Diluted EPS of 31.4 sen (Figure 6). BUY.

-----------

1. First thing first.

OSK - Tuesday, 14 November 2006

Crest Builder Hldgs

Fulfilling The Prophesies

BUY Price RM1.18 Target rm1.84

As prophesised! CB’s share price has risen by 24.2% since our last BUY call a month ago! In fact, much of the gains were attributable to the following catalysts that we have vehemently been advocating:

So what did OSK wrote a month ago?

Monday, 2 October 2006

BUY Price RM0.95 Target RM1.50

Yeah, CB was at 0.95 sen and now it was 1.18 this morning. A BIG 24.2% increase. BRAVO.

But..

consider this..

on 24th May 2006, OSk had a write-up. This was the bare numbers

Recommendation BUY Price RM1.05 12-mth Target Price RM1.49

And on 6th May 2006. This was the bare numbers

Recommendation BUY Price RM1.12 12-mth Target Price RM1.49

All articles writen by same bugger.

So tell me, CBuilder opened at 1.18.

Do you reckon that he DESERVES ALL THE BRAGGING RIGHTS that Cbuilder opened the day at 1.18?

QUOTE: "As prophesised! CB’s share price has risen by 24.2% since our last BUY call a month ago"

how?

![]()

![]()

![]()

2. Next issue.

HOT….! Even with the en-bloc sale aside, CB is to achieve an astounding YoY net profit growth of 169.7% and 34.7% in FY06 and FY07 respectively, an impressive 3-year (FY04-FY07) net profit CAGR of 41% and commendable ROE of 31% and 31.3% in FY06 and FY07 respectively (Figure 5), backed by strong outstanding orderbook of >RM700m and the huge earnings contribution from its property development arm (Figure 3 and 4).

Huh?

Can a growth be defined as astounding when it has yet to be realised???

Which planet is he from?

Those are forecasted numbers. And the higher the forecast, surely the growth would look astounding!!!

I did this little exercise.

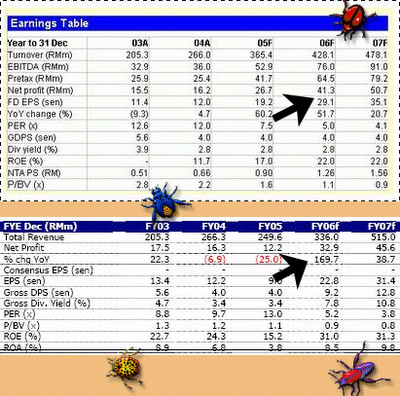

Back in Feb 2006, OSK had a write-up. So, i compared the earnings table in that write-up versus today's writeup. See attached table below.

The top table is Feb 2006 table and the bottom table is today's write-up.

Back in Feb 2006, OSK estimated 41.3 million for CB fy2006.

Today.. the estimates is only 32.9 million.

astounding growth?

3. More on this astounding growth issue.

Let's look at how CBuilder did since fy2003.

net profit

fy 2003 17.5 million

fy 2004 16.3 million

fy 2005 12.2 million

How?

CBuilder is dooing rather poorly since fy 2003. Yes?

And how much did OSK forecast CB's fy 2006 earnings? 32.9 million!

Astounding.

Astounding, Optimistic earnings forecast!

And how is CB doing currently?

CBuilder made only 9.322 million for its first 2 quarters of fy 2006.

Astounding isn't it?

0 comments:

Post a Comment