Megan: Part XIII

Friday, March 31, 2006

In Part XII , I have made the following statements...

- For me, I believe that an investor's primary objective is to invest in only the good, quality companies at a reasonable price. And if that is the case, then the share price or the market reaction to the company's earnings is not in the equation. For the focus is always on gauging the quality of the company. ( If one puts the share price in the equation, the investor focus gets muddled because the likelyhood is that the investor might be focused on what the share will do in the market, will the share go up or will the share go down. And the actual focus on the quality of the company is soon forgotten. )

Ah... in the share market, can it work if one merely focus on the issue of the quality of a company?

Now before I continue, I have to ass-u-me one thing, and that is, me and you, the reader of this blog posting, we believe in investing. It makes no sense to continue reading if one believes otherwise. Right?

So as investor, do you believe that the main objective is to invest only in the good company at a cheap price?

And if so, the key issue is always on the quality of the company. And needless to say, if the company is NO LONGER GOOD, then it makes no sense that we continue to stay invested in the stock, right?

Now, how am I going to prove this issue to all?

Ah, for those that really knows me, I have simply been a big bad bear on Megan (and ... LOL... they are bored stiff reading my comments on Megan!)

Since when?

Well... I believe since 2003... since the very day, Megan decided to play that funky corporate music by purchasing MJC, a funky corporate exercise which saw Megan purchasing MJC, a company owned by its own majority shareholder.

Let me prove to you. Have a look at this screenshot of an old chap-lap forum. (the forum is closed hor).

That was posted on Sept 2003.

And here is another proof. Click here or have a look at the following screenshot. (Click on the picture to have a bigger view)

That was posted in May 2003.

The opinion back then was the Megan shareholders was using the company as a tool to enrich themselves. They, the Singaporean shareholders, used Megan Media, a listed company in Malaysia, to purchase a company in which they have own vested interests. And they sold the company at a premium and with the sale, the existing debts of MJC were sold to Megan.

As mentioned before, when I purchase a stock, I consider myself being a part owner of the business. A business partner. So when my business partner places their ownselves before me, how could I trust being a part owner of such a company? And most important of all, do I see myself benefiting in such a partnership? Can meh? How can I benefit when the owners main priority is to enrich their ownselves?

Hence, how would I rate such a company? How can I possibly value a company that I cannot trust?

Is it wise to buy and hold such a stock forever and ever?

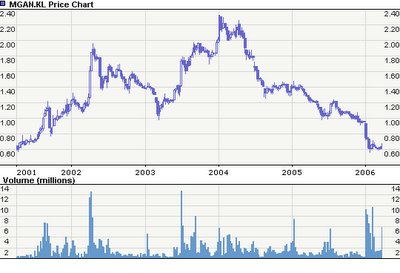

Take a look at this Reuters chart. (do try to verify the accuracy of the chart hor...)

How?

Three worthwhile things to note...

Firstly, I have mentioned many times before (it would be too tedious to prove this also) that there was some real justifications to invest in Megan but this was in 2001. And as can be seen in the chart above, the early investor would have been rewarded nicely for their investment in Megan.

Secondly.. when Megan played their funky music in May 2003, wasn't it a good time to exit the investment?

Was May 2003 a good time to decide to AVOID/EXIT/STAY AWAY from Megan Media?

Ahh... as can see clearly from the chart, perhaps May 2003 wasn't the perfect time to exit Megan and that perhaps maybe Jan/Feb 2004 would have been a better time to exit Megan.

Yup.. it wasn't perfect.... but.... heyyyyyyyyyyyyyy..... was it shabby to exit Megan back in May 2003?

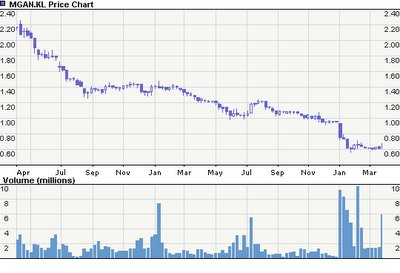

Lastly, buy and hold... if the company quality is no longer good.. is it wise to HOLD and HOPE that it becomes better? Well the best answer for that question is to look at this chart below.. see the devastating result for holding and hoping?

Ahh... yes... some could argue that all this is nonsense and irrelevant already because this is all past. And it's really make no sense to constantly looking at the rear view mirror when one drives... right?

So what lies in the future for Megan?

How will happen to the share price?

Ahh... let me say this again... I have no idea... but as an investor... my issue is simple.

How do I rate the quality of this company?

Now consider these issues.. the depleting cash, the rocketing debts, the rocketing inventory and the extreme high level of trade receivables, the integrity of the management...

and now we have the issue of how Megan accounts its profits (ie the issue of the depreciation rate)..

how? how do you rate the quality of Megan? Do you even think that Megan is an investment grade stock?

If no... why should you bother with the share price?

:D

0 comments:

Post a Comment