Value or Value Trap in Worldwide Holdings?

Wednesday, March 15, 2006

Back in 2004, I was mumbling on Worldwide Holdings. Now I am just curious of the outcome if I were to make another review of it. My new comments will be in red.

29th May 2004.

Quarterly rpt on consolidated results for the financial period ended 31/3/2004

From the quarterly earnings notes, it was reported that the power generation business contributed a net profit of 14.407 million to Worldwide's earnings... and guess what? Worldwide's total net profit for the quarter only stood at 12.454 million.

Er... don't you wonder what is happening in Worldwide?

So if one takes away the Genting Sanyen Power earning contributions, you would get a company that's losing money! Speaks volume of the company's management doesn't it? And to compound the matter worse, Worldwide's stake in Genting Sanyen is only the minority stake. How? How would one evaluate the issue of shareholding risk?

Anyhow, what ails this bugger?

Look at the profit & loss statement... look at the big jump in operating expenses. (28.8 million vs 19.2 million last year)... What is happening here?

Then you have shrinking piggy bank cash (67.4 mil vs 85.7 mil last year) and you also have raising trade receivables (38.7 mil vs 29.9 mil last year)...

And what does the company says about its prospects?

- As the outlook for the property development sector remains favourable the management is confident in registering profits in the current year.

Continuous stable earnings from the Group’s investment in its power generation sector is expected to help maintain the Group’s profitability throughout.

So do you reckon that Worldwide is value or perhaps Worldwide is nothing but a value trap?

==> That was May 2004...

Sept 18th 2004. Worldwide is now trading at 2.04.

There was an article in the star newspaper suggesting that Worldwide Holdings was worth a re-look. Here are some highlights from that article.

- PROPERTY developer Worldwide Holdings Bhd (WHB) may be worth a re-look now that it has regained some ground in recent weeks, after falling for eight months and sinking to a 14-month low of RM1.70 on Aug 24. The counter, which has lost 13.2% year-to-date, closed at RM2.04 yesterday for a two sen gain. WHB shares currently trade at a price/earnings ratio of only six times on this year's annualised earnings, and at a 50% discount to its net tangible assets per share of RM3.91, said SBB Securities Sdn Bhd.

WHB, 53% owned by Perbadanan Kemajuan Negri Selangor (PKNS), has a solid balance sheet, with a net cash position of RM83mil or 48.6 sen per share. And the proposed sale of its loss-making theme park operation in Sydney, Australia, for RM56mil cash is expected to boost the company's cash reserves to almost 81 sen a share.

The property development arm, its main revenue contributor, accounted for 67% of turnover in the first half of the financial year ended June 30, but contributed only RM2mil to group pre-tax profit of RM40mil during the period.

Sooo.... is Worldwide worth a revisit? Why not take a look?

This is their latest earnings...

Quarterly rpt on consolidated results for the financial period ended 30/6/2004

So the very first statement...

- WHB shares currently trade at a price/earnings ratio of only six times on this year's annualised earnings, and at a 50% discount to its net tangible assets per share of RM3.91, said SBB Securities Sdn Bhd.

If we dun check the Quality..... what is the use of buying it at a cheap price?

The theory of buying only good companies at a cheap price is a rather commonsense business thinking right? As an investor, what do we want? Don't we only want the best? Equate it to properties. Do we want to buy a lousy property at a cheap price? Surely Shirley wants only the best property at the best price, right?

Soooo... take a look at the track record.... track record are always very important... say if you look at a company's last 5 year history... and if the track record is rather unexciting, doesn't commonsense suggests that perhaps the next 5 years to be unexciting too?

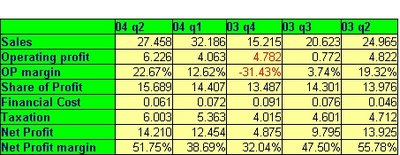

here is Worldwide performance since 1999... how would you rate it?

Does this look like a company with a exciting prospect? It's profitability looks very impressive right? look at those margins... !! But sometimes looks can be very deceiving! Remember the issue that Worldwide's earnings is boosted by its share of 20% in Genting Sanyen Power? If that is the case, perhaps one might want to do a new table with a column indicating this share of profit from Genting Sanyen... and of course add in a column indicating the net profit less Genting Sanyen's earning contributions!

What is one's impression of Worldwide now?

Isn't it clear that if one takes away the Genting Sanyen Power earning contributions, you would get a company that's losing money! And Worldwide would have lost money 3 out of the last 5 fiscal years!

And there is only one verdict here. Utterly poor performance from Worldwide management! Don't you wonder what the management is there for?

Any sign of improvement? From their last reported quarterly earnings, look at their property development, which was supposed to be their CORE business, is still losing money!!

So if one rate the QUALITY of the company to be lousy then what we really have is a lousy company selling at a cheap price! Interested?

Second issue...

- has a solid balance sheet, with a net cash position of RM83mil or 48.6 sen per share.

Anyway, for companies with nice piggy bank(s), don't you want to know what the company does with the excess money, rite? Understanding their historical dividend payouts, would give one an understanding of what to expect, right?

in 2003... Worldwide paid 3 sen tax exempt... (paid in Aug 2003)

in 2004... Worldwide paid 5 sen tax exempt... (paid in July 2004)

Sooo..... you probably might be safe to ass-u-me that Worldwide will pay at least a 5 sen tax exempt next year....

Worldwide closed at 2.04.

So if Worldwide pays the equivalent amount in dividend... then investing in it will see a possible stock paying one a yearly dividend yield of around 2.5%... Err.... is this yield attractive?

Commonsene thingy. Is this the best available investment for our money? Surely, Shirley there simply has to be another better choice?

(ahh... die! Remember Never Say I Ass-U-Me! Did you see that I said 'you probably might be safe to ass-u-me that Worldwide will pay at least a 5 sen tax exempt for next year'? Well if one had invested in Worldwide in Sept 2004 at a price of 2.04, Worldwide actually paid a total gross dividend of 10 sen, or a dividend yield of 5%!... and in January 2006, Worldwide paid a 3.6 sen tax exempt + 2 sen less tax interim dividend!)

WOW! too long already... to be continued ...

0 comments:

Post a Comment