Privatisation of Johor Port

Tuesday, March 7, 2006

I have spoken against the issue of privatisation of listed subsidiaries and one of the stocks highlighted was the privatisation of Johor Port.

OSK had a report recommending that the minority shareholders should accept the offer. Before looking at what is said today's article, I thought it would be an interesting exercise if I search thru OSK website for their past write-ups on Johor Port. It gets pretty puzzling.

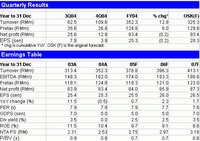

Check it out ... (I want to pay attention to the 2005F and 2006F forecast numbers)

1. http://www.osk188.com/article.jsp?id=19380

March 1st 2005. Price 2.00 12-month target price 2.50 BUY

2005F = 84.0, 2006F=85.9

2. http://www.osk188.com/article.jsp?id=19816

April 7th 2005. Price 1.87 12-month target price 2.50 BUY

2005F = 84.0, 2006F=85.9

3. http://www.osk188.com/article.jsp?id=20587

June 17th 2005. Price 1.80 12-month target price 2.50 BUY

2005F = 98.7, 2006F=90.6 (increased)

4. http://www.osk188.com/article.jsp?id=21103

August 11th 2005. Price 2.02 12-month target price 2.60 BUY

2005F = 102.00, 2006F=94.7 (increased)

5. http://www.osk188.com/article.jsp?id=21149

August 18th 2005. Price 1.87 12-month target price 2.70 BUY

2005F = 102.00, 2006F=94.7

6. http://www.osk188.com/article.jsp?id=21246

August 24th 2005. Price 1.88 12-month target price 2.70 BUY

2005F = 108.5, 2006F=95.4 (increased)

7. http://www.osk188.com/article.jsp?id=21634

September 29th 2005. Price 2.12 12-month target price 2.66 BUY

2005F = 108.5, 2006F=95.4

8. http://www.osk188.com/article.jsp?id=22253

December 1st 2005. Price 2.28 12-month target price 2.70 BUY

2005F = 114.7, 2006F=95.3 (waa... 2005 numbers jacked UP somemore!!!)

9. http://www.osk188.com/article.jsp?id=22329

December 9th 2005. Price 2.37 12-month target price 2.50 ACCEPT OFFER!

2005F = 114.7, 2006F=96.4

10. http://www.osk188.com/article.jsp?id=23069

March 7th 2006. Price 2.42 12-month target price 2.50 ACCEPT OFFER!

2006F=106.1

Johor Port did 101.9 million.

OSK mentioned the following.

- Slightly below estimates . Net profit of RM101.9m was below our forecast by 5.6% and consensus by 8.9% as higher depreciation charges were incurred and less interest income was booked with the loan repayment from Seaport Terminal.

Was it even slightly below estimates?

Look at those numbers... at 2.50... was the offer even fair?

==>>

From the earlier blog posting (Privatisation issues )

The issue of privatisation and the subsequent delisting of a listed subsidiary.

Generally there are two ways companies can be delisted from a stock exchange in.

The first case is the enforced, compulsary delisting of a company, in which the stock exchange forces the delisting of the stock because the listed company has failed to comply with the stock exchange listed requirements. And these are usually based on commercial reasons in which the listed companies simply cannot operate in a profitable manner.

The second manner a company can be delisted from a stock is where the company voluntary imforms the exchange that they no longer want to be listed. And a variation of this case, is the delisting of a listed subsidary is made by its holding company, in which the minority shareholder of the listed company is forced to choose between the offered compensation price or risk being involved in a private company, which would ultimately offers no transparency rights.

I have no problem at all with the first case. These are them koyak companies. Chap-lap companies which are losing money like crazy.

The second one, the privatisation and the subsequent delisting of the listed subsidiary, this one i really dun like at all.

It's just totally unfair to the minority shareholder and it makes a total mockery of the whole stock exchange. Listed Companies should not be given the approval so easily to privatise their listed subsidary company in which the general investing public is forced or threatened with the issue of delisting. And as mentioned earlier once the company is delisted this offers the investor no transparency rights at all. So when a listed company is able to list and delist their subsidary companies as per their whimps and fancy this would make a total mockery of the stock exchange.

And what about the general offer price for the minority shareholders stake in that listed company? Would the minority shareholders get an offer that is fair or would the minority shareholder be placed in a disadvantage position? Would the premium offered over the existing share price to adequetly compensate the minority investors?

If no, this ultimately means that the minority investors would never be given a chance to being adequately compensated for the permanent withdrawal of a good investment opportunity. And if this is the case, then this would contradict the government's plan to woo more investors into Bursa Malaysia cause investing would have indeed turned very unattractive, a game which is very biased against the investing public.

0 comments:

Post a Comment